Prairie City Tax Increment Financing

The City of Prairie City invests in the future of the community through Tax Increment Financing (TIF). With TIF, Prairie City may take an increment of projected property taxes earned through improvements made by a developer, and rebate all or a portion of the money back to the business or organization to use in a number of possible manners.

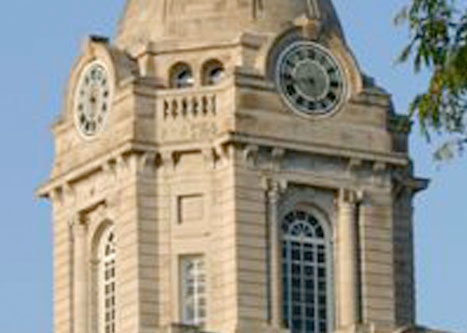

Prairie City Iowa

Prairie City Development Tools and Financial IncentivesCategory: Local Incentives

More Local Incentives

The Business Property Tax Credit is part of the 2013 property tax reform bill. This credit is available for certain commercial, industrial and railroad properties. The credit is applicable to individual parcels as well as “property units” (contiguous parcels of the same classification that are...

Learn More

Colfax Main Street operates a revolving loan program for local Colfax businesses and industries. This program provides low-interest loans for projects that will create new jobs, support business maintenance and expansion, or create new business options. Any business or industry located within the City of...

Learn More

Jasper County Economic Development Corporation has two funding programs available for JEDCO communities: the Jasper County Facade Improvement Program and the JEDCO Small Grants Program.For more information about these programs, contact Jeff Davidson, Executive Director, Jasper County Economic Development Corporation (JEDCO) at jedcoiowa@gmail.com.Jasper County Facade...

Learn More

The City of Monroe has a grant program for improving the facades of buildings in downtown Monroe and the adjacent area. For more information contact Monroe City Clerk Kim Thomas.

Learn More

Purpose: To assist property and business owners with building improvements that will enhance the downtown experience and community aesthetics while preserving the historic character of the buildings.

Eligibility: All commercial buildings and businesses in the Main Street District are eligible. The applicant must demonstrate...

Learn More

The Downtown Revitalization Incentive Program offers up to $15,000 for making eligible interior and/or exterior improvements to property in the Downtown Revitalization District.

Learn More

Through the Prairie City Revitalization Plan, business owners may be eligible for exemption from some or all property taxes for improvements made to a qualifying property. The owner will still be responsible for paying taxes on the initial value of the property, and will only...

Learn More

The City of Prairie City offers a $3,000 grant to eligible property owners who wish to demolish substandard, deteriorated, or dilapidated buildings that are vacant and located within city limits. If approved, the grant covers costs for demolition, debris removal, and site grading.

Learn More